Shipping Update

Oil Market: Insight into Future

20th March 2017

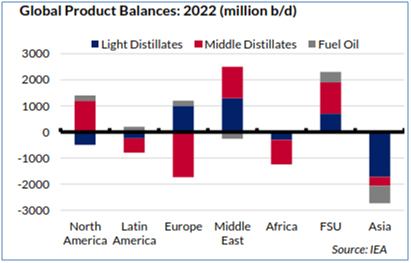

- Product balances in Europe are expected to see little change between 2016 and 2022 as Europe will remain short on middle distillates (gasoil/kerosene), and long on lighter distillates (gasoline/naphtha) signalling limited prospects for European imports generating increased tonne mile demand, given the product is likely to remain primarily supplied by the US, Former Soviet Union (FSU) and Middle East/India.

- The US will have a shortage of about 0.5 million b/d of gasoline, similar to the current picture, whilst other regions such as Africa and Latin America post small deficits for the lighter ends.

- The medium term oil market report of IEA suggests that Africa’s shortage of lighter distillates will be the same in 2022 as it is today and there is a significant assumption that the Lekki refinery in Nigeria, which is slated for start up sometime next year will not be impacting the market until 2022.

- Given the track record of refining in Nigeria, there is uncertainty as to whether this plant can be built within the next 5 years and run consistently near design capacity.

- In terms of middle distillates, Africa and Latin America will see their import requirements shrink marginally to a combined 1.5 million b/d with the primary sources of supply likely to be the US, Middle East (inc. India) and Russia.

- Globally, the Middle East will continue to be the primary source of export growth over the forecast period as the regions surplus of gasoil will grow by approximately 70% over the next five years, whilst the light distillates surplus will post growth of 85% over the same period.

- Asia’s shortage of gasoline/naphtha will grow by over 0.5 million b/d by 2022 signifying a downwards revision compared to 2016 report, Asia’s growing product deficits will support long haul imports from both the Middle East and Atlantic basin, generating incremental tonne mile demand, in spite of declining exports from the region.